Quaid Paid It, We Should Pay It.

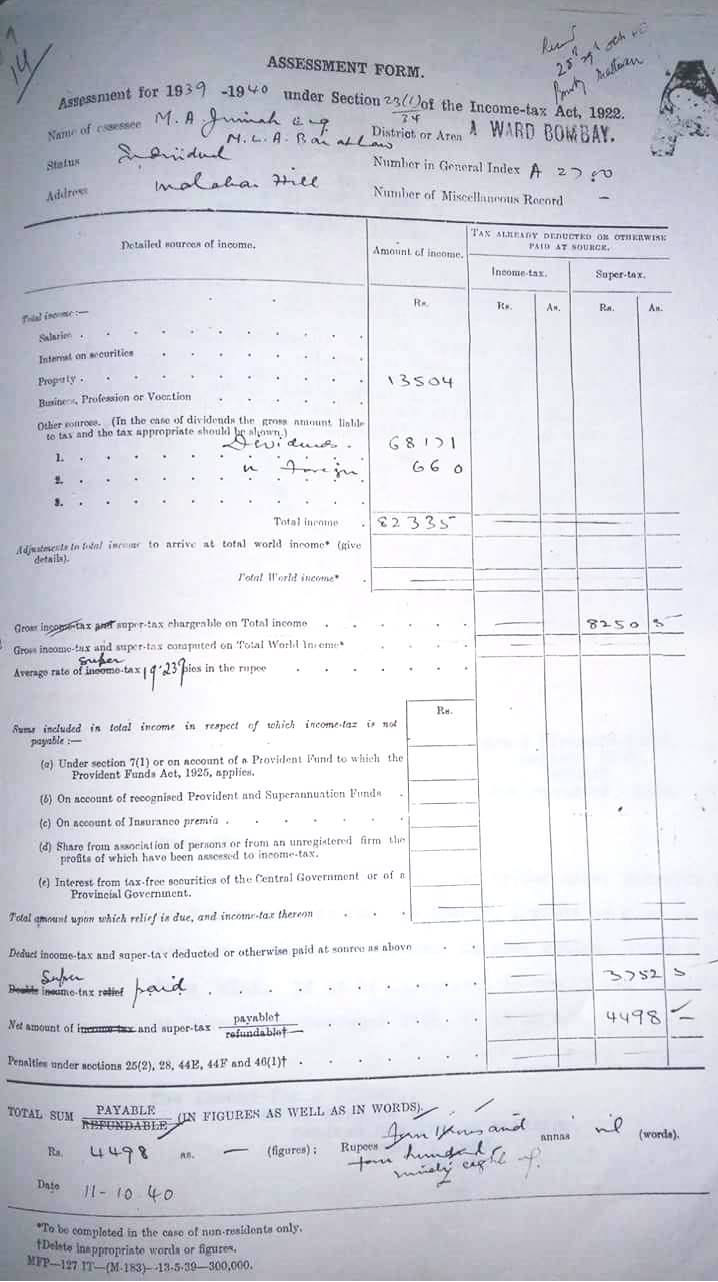

Being a citizen of Pakistan is it our legal and national responsibility to file Income Tax Return. Here we are enclosing the Income Tax Return of Quaid e Azam Muhammad Ali Jinnah, which is his first income tax return after the independence of Pakistan.  Sadly, Tax submission rates of Pakistan declining day by day, even the educated beings of Pakistan concealing from it. Likewise, a recent survey shows Pakistan has the lowest 0.9 Tax to GDP ratio in the world. Moreover, our core purpose is to arise social and legal responsibility in individuals of Pakistan to E-file their Income Tax Return for the betterment of Pakistan. Furthermore, we can assist and help them through all the means in economic rates with the highly competent workforce to uplift their responsibilities and build legal and national awareness.

Sadly, Tax submission rates of Pakistan declining day by day, even the educated beings of Pakistan concealing from it. Likewise, a recent survey shows Pakistan has the lowest 0.9 Tax to GDP ratio in the world. Moreover, our core purpose is to arise social and legal responsibility in individuals of Pakistan to E-file their Income Tax Return for the betterment of Pakistan. Furthermore, we can assist and help them through all the means in economic rates with the highly competent workforce to uplift their responsibilities and build legal and national awareness.

Importance of Paying Taxes

As per recent world bank report specifies:

“The tax-to-GDP ratio, at 12.4 percent, is one of the lowest in the world and it is still half of what it could be for Pakistan. Also, continued reforms to broaden the tax base and increase revenues will therefore need to remain a priority. Service delivery is the responsibility of subnational governments, whose capacity varies, but the federal government needs to play an assertive stewardship role as increased financing has to be accompanied by meaningful improvements in quality of services.” So, you can read the complete report here.

Also, you can find Quaid e Azam Muhammad Ali Jinnah income tax return below:

It is the responsibility of every citizen to pay all the taxes. There are hundreds of law firms willing to guide people for their income tax returns. So, you should ask for guidance if you consider this to be necessary. Not paying the taxes on time is certainly not a patriotic thing and no one should commit this mistake. Moreover, it is considered a crime in Pakistan or any other country of the world. So, you should not be doing this mistake. KLA Pakistan provides expert accurate tax consultancy services for salaried businesses of all sizes. We at KLA Pakistan help you in obtaining National Tax Number NTN (Income Tax Registration). Comprehensive assistance in Preparing and filing Income Tax returns. and compliance with Tax Notices and Audits. Get in touch today — Complex Issues, Specialist Advice!

FOR ALL YOUR BOOKKEEPING REQUIREMENTS, CONSULT OUR PROFESSIONALS.

You might find these further articles useful:

Why you should Audit your Financial Statement

Advantages and Benefits of Company Registration in Pakistan

Benefits of FBR NTN and online NTN Verification

If Your Goal Is To Get Biggest Refund Possible

Show Us Your Love, Join Us At:

Leave a Reply

Want to join the discussion?Feel free to contribute!